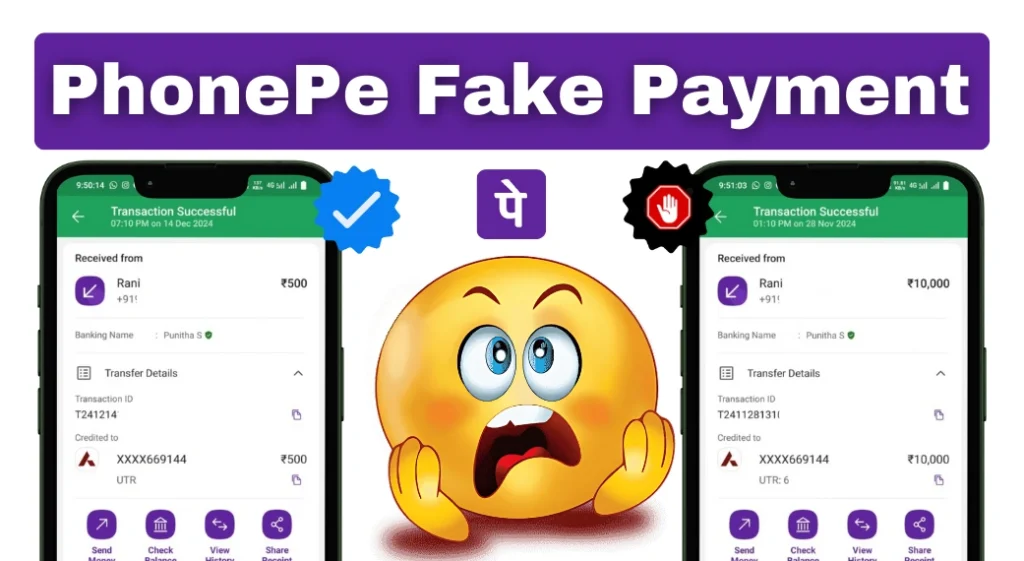

With the increasing reliance on digital payments, fraudulent practices like creating fake PhonePe payments are on the rise. Scammers use tools like fake PhonePe payment generators and fake PhonePe payment apps to deceive merchants and individuals. These tools allow fraudsters to create fake PhonePe payment screenshots that mimic legitimate transactions, leaving victims unaware until they realize no money was transferred.

In this guide, we’ll discuss fake PhonePe payments, how they work, the dangers they pose, and how to stay protected.

- What is a Fake PhonePe Payment?

- How Does a Fake PhonePe Payment Work?

- Why Do People Use Fake PhonePe Payments?

- Common Tools Used for Fake PhonePe Payments

- Signs of a Fake PhonePe Payment

- Real PhonePe Payment vs. Fake Payment

- Dangers of Using or Falling for Fake PhonePe Payments

- How to Protect Yourself from Fake PhonePe Payments

- What to Do If You Fall Victim to a Fake PhonePe Payment?

- Alternatives to Avoid Fake Payments

- Frequently Asked Questions (FAQs)

- Disclaimer

What is a Fake PhonePe Payment?

A fake PhonePe payment is a fraudulent act where scammers use third-party apps or editing tools to simulate legitimate PhonePe transactions. These scams often involve generating fake receipts or creating fake PhonePe payment screenshots to trick victims into believing that a payment has been completed.

Fraudsters use keywords like fake PhonePe payment generator APK download or fake PhonePe payment APK to spread these tools across the internet.

How Does a Fake PhonePe Payment Work?

| Stage | How It Happens |

|---|---|

| Using a Fake Payment Generator | Scammers use tools like fake PhonePe payment generators to create fake receipts. |

| Manipulating Screenshots | Editing tools or apps like fake PhonePe payment screenshot makers are used to forge payment proofs. |

| Quick Deception | Fraudsters quickly show the fake payment screenshot to avoid suspicion. |

| No Actual Transaction | No real money is transferred; the scammer relies on the victim’s trust in the fake proof. |

Why Do People Use Fake PhonePe Payments?

1. To Avoid Paying for Goods or Services

- Fraudsters use fake PhonePe payment apps to trick shopkeepers, vendors, or service providers into thinking they’ve received payment.

2. Ease of Accessibility

- Tools like fake PhonePe payment generator download APKs are readily available online, making it easy for scammers to create convincing fake receipts.

3. Lack of Verification by Victims

- Many merchants and individuals fail to verify payments in real time, allowing scammers to exploit the situation.

4. To Commit Fraud

- Fake payments are often used to scam buyers in online transactions, leaving them without the goods or services they paid for.

Common Tools Used for Fake PhonePe Payments

- Fake PhonePe Payment Generators: These apps mimic the PhonePe interface and create fake transaction IDs and payment receipts.

- Fake PhonePe Payment APKs: Modded apps allow users to manipulate transaction details within the app interface.

- Fake PhonePe Payment Screenshot Makers: Editing tools or dedicated apps enable fraudsters to alter genuine screenshots or create fake ones.

- Downloadable APKs: Scammers often share tools labeled as fake PhonePe payment generator APK downloads, targeting unsuspecting users.

Signs of a Fake PhonePe Payment

- No Official SMS or Email Confirmation: Genuine payments always trigger an SMS or email from PhonePe to both the sender and recipient.

- Unverifiable Transaction ID: Fake receipts often have random or invalid transaction IDs that cannot be verified in the PhonePe app.

- No Update in Bank Account: A real payment will reflect in the recipient’s bank account or UPI app almost instantly.

- Suspicious App Behavior: Fake apps or screenshots may have inconsistencies, such as spelling mistakes or poor-quality visuals.

Real PhonePe Payment vs. Fake Payment

| Aspect | Real PhonePe Payment | Fake PhonePe Payment |

|---|---|---|

| Transaction ID | Authentic and verifiable in the app. | Randomly generated or invalid. |

| Confirmation | Sends SMS and app notifications to both parties. | No official confirmation is received. |

| Funds Transfer | Money is transferred to the recipient’s account. | No actual money is transferred. |

| Source | Only available through the Google Play Store or Apple App Store. | Distributed through unofficial APKs. |

Dangers of Using or Falling for Fake PhonePe Payments

For Victims:

- Financial Loss: Merchants or individuals may lose money by delivering goods or services without receiving payment.

- Trust Issues: Repeated incidents of fake payments can erode trust in digital payment systems.

For Fraudsters:

- Legal Consequences: Using fake payment PhonePe tools is a criminal offense under Indian law.

- Account Restrictions: Bank accounts or UPI profiles associated with fraudulent activities may be permanently banned.

How to Protect Yourself from Fake PhonePe Payments

| Tip | Details |

|---|---|

| Always Verify Payments | Check the UPI transaction ID in the PhonePe app or with your bank directly. |

| Avoid Trusting Screenshots | Do not rely solely on screenshots or receipts as proof of payment. |

| Use Real-Time Validation | Ensure payments are reflected in your account before delivering goods or services. |

| Download Only from Official Sources | Use the Google Play Store or Apple App Store to download PhonePe. |

| Enable Notifications | Keep SMS and email alerts active for every transaction. |

What to Do If You Fall Victim to a Fake PhonePe Payment?

- Report to PhonePe Support: Contact PhonePe’s official support team and provide all details of the fake payment.

- File a Complaint: Report the incident to your bank and file a complaint through the NPCI UPI help portal.

- Inform Law Enforcement: Notify your local cybercrime division with evidence, such as fake receipts or suspicious APKs.

- Educate Your Network: If you’re a merchant, train your staff to verify payments before delivering goods.

Alternatives to Avoid Fake Payments

If you’re wary of such scams, here are secure alternatives to ensure safe transactions:

| App | Features |

|---|---|

| Google Pay | Trusted UPI payments with instant confirmation and fraud detection. |

| Paytm | Secure payments with added features like digital wallets and fraud alerts. |

| Amazon Pay | Offers verified payment processes integrated with Amazon services. |

| BHIM UPI | Official UPI app backed by the Government of India, with robust safety features. |

Frequently Asked Questions (FAQs)

What is a PhonePe Fake Payment?

A PhonePe fake payment is a fraudulent transaction simulated using counterfeit apps or edited receipts to deceive victims.

How can I detect a PhonePe Fake Payment?

Check for genuine UPI transaction IDs, real-time bank updates, and official SMS or email confirmations. Fake payments often lack these.

Is using a Fake Payment App illegal?

Yes, using fake payment apps is a criminal offense under Indian law and can result in legal consequences.

What should I do if I suspect a fake payment?

Verify the payment in real time using the PhonePe app or your bank account. If confirmed as fake, report it to the authorities.

How can I report a PhonePe Fake Payment?

Contact PhonePe customer support, your bank, or file a complaint on the NPCI UPI help portal. You can also report the incident to your local cybercrime division.

Disclaimer

The information provided in this article, authored by M Raj and published on apptn.in, is intended for educational and informational purposes only. The article aims to raise awareness about PhonePe fake payment scams and does not promote or endorse any fraudulent activities or unauthorized use of digital payment platforms.

Users are strongly advised to use only legitimate digital payment methods and download apps exclusively from official sources such as the Google Play Store or Apple App Store. The author and website are not responsible for any financial losses, security breaches, or legal consequences resulting from the misuse of information or digital payment systems. Always exercise caution and verify transactions to ensure safety.

More Articles You May Like

500

Fake phonepe

100000000

Yes

6206645700

Neearj

10000

mareko fake phone pay chiye

Very good helpful