In the era of digital payments, apps like Google Pay have revolutionized how we transfer money and make transactions. However, with growing usage comes the risk of fraudulent activities. The rise of fake Google Pay scan apps on Android has led to many innocent users falling victim to scams, resulting in financial losses.

These fake apps are designed to look like the official Google Pay app but are used by scammers to steal sensitive information or trick people into making false payments. Recognizing these threats and understanding how they work is crucial for protecting yourself from financial fraud.

- 📌 How Fake Google Pay Scams Work

- 📌 Common Signs of Fake Google Pay Scans

- 📌 Warning Signs of Fake Google Pay Scans

- 📌 Risks and Consequences of Falling for Fake Google Pay Scams

- 📌 How to Identify and Avoid Fake Google Pay Scams

- 📌 Legal Actions and Reporting Fraud in India, USA, and Europe

- 📌 Top Security Apps to Prevent Payment Frauds

- 📌 Understanding Fake Google Pay Scan Apps on Android, iOS, and PC

- 📌 How to Stay Safe from Fake Google Pay Scams

- 📌 Frequently Asked Questions (FAQs) About Fake Google Pay Scan on Android

- 📌 Disclaimer

📌 How Fake Google Pay Scams Work

Scammers have developed clever ways to manipulate users through fake Google Pay QR codes and payment screens. Here’s how these scams typically operate:

🛑 Step-by-Step Breakdown of the Scam:

- Fake QR Codes: Scammers share fake Google Pay QR codes that look authentic but are designed to redirect payments to their accounts.

- Payment Confirmation Screens: They show pre-recorded or edited screenshots/videos mimicking successful payment notifications.

- Fake Google Pay Apps: Some scammers use apps that display fake transaction confirmations to deceive shopkeepers and customers.

- Phishing Links: Victims receive SMS or emails with links that download malicious apps posing as Google Pay.

- Malware Injection: Some apps collect sensitive data like bank account details, UPI IDs, and even OTP codes.

🚩 Popular Methods Used by Scammers:

- Social Engineering: Convincing victims over the phone to scan QR codes.

- Fake App Interfaces: Fake apps that mimic the original Google Pay UI.

- Fraudulent Customer Support Numbers: Scammers impersonate official support to access user data.

📌 Common Signs of Fake Google Pay Scans

Recognizing the signs of a fake Google Pay scam can prevent financial loss. Below are common warning signs:

⚠️ Red Flags to Watch Out For:

- Unverified Apps: Apps downloaded from third-party websites or unofficial app stores.

- Suspicious QR Codes: QR codes shared via messaging apps that claim to offer discounts or instant payments.

- Request for OTPs or PINs: Google Pay never asks for sensitive details like PINs or OTPs.

- Fake Transaction Screens: Blurry or static screenshots shown as payment proof.

- Unusual Payment Requests: Random payment requests from unknown contacts.

🛡 How to Identify a Fake App:

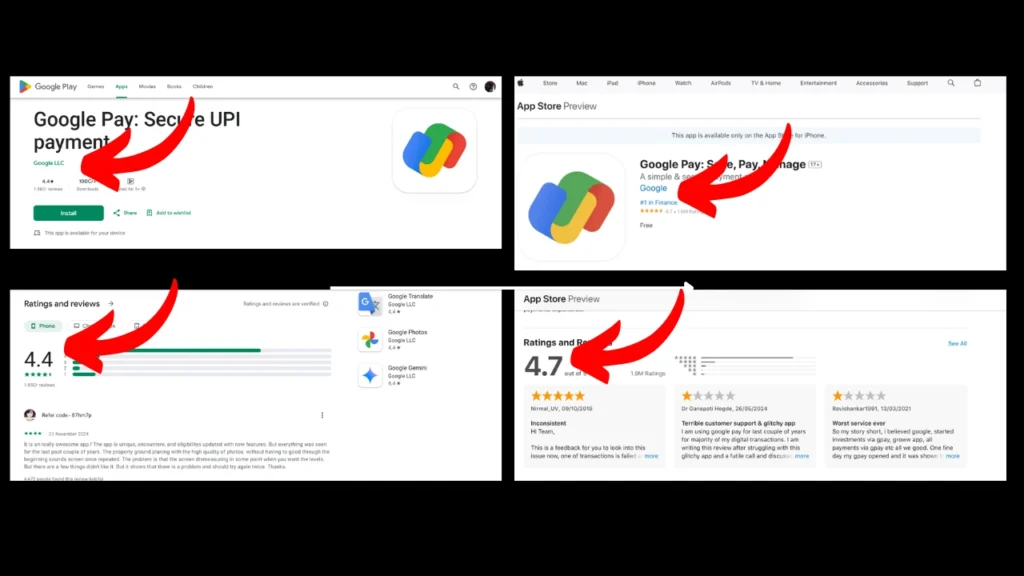

- Check the Developer: Official Google Pay is developed by Google LLC.

- Verify App Reviews: Poor reviews and low download counts are warning signs.

- Look for Typos: Fake apps often contain spelling and grammatical errors.

- Permissions: Unnecessary permissions (camera, contacts) can be suspicious.

🔔 Tip: Always download apps from the Google Play Store or App Store to ensure safety.

📊 Scam Techniques vs Legitimate Transactions

| Scam Technique | Legitimate Google Pay Feature |

|---|---|

| Fake QR Codes | Official Google Pay QR Codes |

| Edited Payment Screenshots | Real-Time Payment Notifications |

| Phishing Links | Official Google Pay App/Website |

| Fake Payment Requests | Authentic Pay & Request Features |

📌 Warning Signs of Fake Google Pay Scans

Recognizing the early signs of a Fake Google Pay Scan can help protect you from financial fraud. Scammers use sophisticated tactics to trick users into making payments or sharing sensitive information.

🚨 Common Red Flags to Watch Out For:

- Suspicious QR Codes: QR codes shared on unofficial websites or social media groups may redirect to fraudulent payment portals.

- Unverified Google Pay Apps: Fake apps imitating the original Google Pay interface can steal user credentials.

- Urgent Payment Requests: Scammers create a sense of urgency, pressuring you to scan a QR code quickly.

- Unfamiliar Payment Notifications: Receiving a payment request from an unknown number or email is often a scam.

- No Confirmation Messages: Google Pay always sends transaction confirmations. If you don’t receive one, it’s a red flag.

- Too-Good-To-Be-True Offers: Promises of cashback or discounts for scanning certain QR codes are often scams.

⚠️ Example of a Scam:

A scammer posing as a seller on OLX shares a QR code and asks for a payment confirmation. The buyer unknowingly scans the code, transferring money instead of receiving it.

📌 Risks and Consequences of Falling for Fake Google Pay Scams

Fake Google Pay scams on Android devices can have severe consequences, affecting not just your financial health but also your personal security.

⚠️ Key Risks Involved

- Financial Loss: Scammers trick users into transferring money by using fake payment confirmations or QR codes. Victims may lose large amounts of money instantly.

- Identity Theft: Fraudsters can collect sensitive personal information such as bank account details, contact numbers, and identity proof, leading to identity theft.

- Data Breaches: Fake apps or malicious links can install spyware on your device, exposing your private data.

- Unauthorized Transactions: Hackers can gain access to your Google Pay account and make unauthorized payments.

- Psychological Stress: Victims often face mental distress after realizing they have been scammed.

📊 Risk Comparison Table

| Type of Risk | Impact | Severity |

|---|---|---|

| Financial Loss | Unauthorized transactions and money theft | 🔴 High |

| Identity Theft | Personal data misuse | 🔴 High |

| Malware Infections | Device compromise through fake apps | 🟠 Moderate |

| Account Breach | Unauthorized access to payment accounts | 🔴 High |

| Emotional Impact | Anxiety and stress after being scammed | 🟠 Moderate |

⚠️ Note: Once scammers gain access to sensitive data, reversing the damage becomes extremely difficult.

📌 How to Identify and Avoid Fake Google Pay Scams

🔍 Signs of a Fake Google Pay Scan or Scam

- Fake Payment Screenshots: Fraudsters may send fake payment confirmations to trick merchants or users.

- Suspicious QR Codes: Scammers often use manipulated QR codes that redirect payments to their accounts.

- Clone Apps: Downloading apps from unofficial sources could install a fake Google Pay app on your phone.

- Unusual Requests: If someone insists on scanning a QR code to receive money, it’s likely a scam.

- Spelling Errors: Look for misspellings or poor design in the app interface or payment confirmation screens.

✅ Tips to Avoid Fake Google Pay Scams

- Download Only from Official Stores: Always download the Google Pay app from the Google Play Store or Apple App Store.

- Verify Payment Notifications: Check your bank or UPI SMS notifications to confirm payments.

- Use Google Pay’s In-App QR Scanner: Scan QR codes using the app’s built-in scanner.

- Enable Security Features: Activate features like App Lock, Fingerprint Authentication, and Transaction Alerts.

- Avoid Sharing UPI PINs: Never share your UPI PIN or OTP with anyone, even if they claim to be from Google Pay.

- Report Suspicious Activity: Use the Report a Problem feature in the app or contact Google Pay support (Help and Customer Care India).

📊 Fraud Detection vs. Prevention Table

| Fraud Sign | Prevention Action |

|---|---|

| Fake Payment Screens | Verify payment via bank SMS or UPI app |

| Strange QR Codes | Use the app’s built-in QR scanner |

| Fake Apps | Install apps only from official stores |

| Unsolicited Requests | Decline and report suspicious users |

📌 Legal Actions and Reporting Fraud in India, USA, and Europe

If you fall victim to a Google Pay scam, it’s crucial to take immediate legal action. Different regions have dedicated systems to handle digital payment frauds.

🇮🇳 Reporting in India:

- Cyber Crime Portal: www.cybercrime.gov.in

- Google Pay Support: Report directly through the app.

- Helpline: Dial 1930 for financial fraud reporting.

🇺🇸 Reporting in the USA:

- Federal Trade Commission (FTC): www.ftc.gov

- Internet Crime Complaint Center (IC3): www.ic3.gov

- Google Pay Help Center: Contact support via the app.

🇪🇺 Reporting in Europe:

- Europol Cybercrime Reporting: www.europol.europa.eu

- Google Pay Support: Access help directly through your Google account.

⚖️ Legal Actions:

- Filing an FIR: Report the fraud to your local police station.

- Consult a Cyber Lawyer: Seek legal advice if the scam involves large sums of money.

- Bank Notification: Inform your bank to freeze or monitor your account for fraudulent transactions.

📌 Top Security Apps to Prevent Payment Frauds

Enhancing your smartphone security with trusted apps can protect you from digital payment scams, including fake Google Pay scans.

📱 Best Security Apps for Android and iOS:

| App Name | Platform | Key Features |

|---|---|---|

| Google Play Protect | Android | Real-time app scanning and malware detection. |

| Norton Mobile Security | Android/iOS | Anti-phishing, Wi-Fi security, and app advisor. |

| McAfee Mobile Security | Android/iOS | Data privacy, anti-theft, and app lock. |

| Bitdefender Mobile Security | Android/iOS | Malware protection and web security. |

| Kaspersky Mobile Security | Android/iOS | Anti-virus, app lock, and web filter. |

🔒 Tip: Keep your apps and operating system updated to close security vulnerabilities.

📌 Understanding Fake Google Pay Scan Apps on Android, iOS, and PC

With the growing popularity of digital payment apps like Google Pay, scammers have created fake Google Pay scan apps to trick users into fraudulent transactions. These counterfeit apps are designed to look identical to the official Google Pay app but operate with malicious intent, putting users’ personal data and money at risk.

📱 Fake Google Pay Scan on Android

- Easily Distributed APKs: Android users are more vulnerable due to the open-source nature of the platform, making it easier for scammers to distribute fake APK files.

- Fake QR Codes: Fraudsters send malicious QR codes via messaging apps, leading users to phishing pages.

- Modified Apps: Some fake apps mimic Google Pay’s interface to collect sensitive information like bank details and OTP codes.

🍏 Fake Google Pay Scan on iOS

- More Secure but Not Immune: iOS has stricter app regulations, but scammers may still use phishing links and fake QR codes to target iPhone users.

- Social Engineering: Fraudsters exploit social media platforms and emails to trick users into sharing payment information.

💻 Fake Google Pay Scan on PC (Desktops/Laptops)

- Phishing Websites: Scammers create fake websites that look identical to Google Pay’s interface, tricking users into entering their login details.

- Malware Links: Clicking on suspicious payment links can install malware that records keystrokes or steals financial data.

📌 How to Stay Safe from Fake Google Pay Scams

✅ For Android Users:

- Download apps only from the Google Play Store.

- Avoid installing apps from third-party websites.

- Double-check the developer name (Google LLC) before downloading.

✅ For iOS Users:

- Install apps strictly from the Apple App Store.

- Be cautious of links shared via emails or messages.

- Enable two-factor authentication (2FA) for extra security.

✅ For PC Users:

- Avoid clicking on suspicious payment links or pop-ups.

- Regularly update antivirus software.

- Only use the official Google Pay website for transactions.

📌 Frequently Asked Questions (FAQs) About Fake Google Pay Scan on Android

This section is specifically for users who want to clear their doubts regarding Fake Google Pay Scams on Android.

✅ 1. What is a Fake Google Pay Scan on Android?

A Fake Google Pay Scan is a fraudulent QR code or payment link designed to trick users into sending money to scammers. These scams often mimic legitimate Google Pay transactions but secretly redirect funds to the scammer’s account.

✅ 2. How Do Fake Google Pay Scams Work?

Scammers create fake QR codes or payment requests and share them through text messages, emails, or social media. When users scan these QR codes or click suspicious links, they are tricked into authorizing payments, thinking it’s a legitimate request.

✅ 3. How Can I Identify a Fake Google Pay QR Code?

Check the Payment Request: Legitimate transactions usually don’t ask you to scan a QR code to receive money.

Verify the Sender: Confirm the identity of the person or business requesting payment.

Look for Typos or Errors: Fake payment pages often have spelling mistakes or low-quality designs.

Avoid Random QR Codes: Don’t scan QR codes sent by unknown contacts.

✅ 4. What Should I Do If I Scanned a Fake Google Pay QR Code?

Immediately contact your bank to block or reverse the transaction.

Report the incident to Google Pay Support.

File a complaint on cybercrime portals like cybercrime.gov.in (India) or local authorities in your country.

Unlink your payment account temporarily for safety.

✅ 5. How Can I Protect My Google Pay Account from Scammers?

Enable 2-step verification on your Google account.

Avoid scanning QR codes from untrusted sources.

Regularly check your transaction history.

Set app locks or PINs on your payment apps.

Use Google Pay’s built-in security features for verification.

✅ 6. Can Scammers Steal Money by Scanning My QR Code?

❌ No. Scammers cannot take money by scanning your QR code. However, they may send fake payment links or ask you to scan their fraudulent QR codes to trick you into sending money.

✅ 7. Is Google Pay Safe to Use for Payments?

Yes. Google Pay is safe and secure when used properly. However, users must stay vigilant against fraudulent QR codes and payment scams. Always verify the recipient before making a transaction.

✅ 8. How to Report Fake Google Pay Scams in the USA?

Report to Google Pay Support: Visit the Help Center in the app.

Contact Your Bank: Notify your bank immediately.

Report to the FTC: File a complaint at reportfraud.ftc.gov.

Call Local Authorities: Report the scam to your local police department.

✅ 9. Why Do Scammers Target Google Pay Users?

Google Pay is widely used for instant transactions, making it an easy target for scammers to exploit unaware users through fake QR codes and payment requests.

✅ 10. Can Google Pay Refund Money Lost to Scams?

Google Pay generally does not refund money lost in scams since transactions are authorized by the user. However, you should immediately report the scam to your bank and Google Pay Support to try and resolve the issue.

📌 Disclaimer

✍️ Author: M Raj | Published on apptn.in

This article is intended for educational and informational purposes only. apptn.in does not promote, encourage, or support any illegal activity related to the creation, distribution, or use of fake Google Pay scan codes or any fraudulent financial practices. This content is strictly designed to educate users about online scams, raise awareness, and help protect users from falling victim to fraud.

📌 1. Affiliation

apptn.in is not affiliated, associated, endorsed, or sponsored by Google LLC or its product, Google Pay. All trademarks, logos, and product names are the property of their respective owners.

For official and verified information, please refer to:

- Official Website: www.google.com

- Google Pay Help Center: support.google.com/pay

- Google Play Store: Download Google Pay

📌 2. Contact the Official Developer

For concerns related to Google Pay, users should directly contact Google:

- Developer: Google LLC

- Official Website: www.google.com

- Email: support.google.com

- Privacy Policy: Read Here

- Terms of Service: Read Here

📌 3. Privacy and Data Collection

apptn.in does not collect, store, or share any personal data related to Google Pay or any other financial applications discussed in this article.

Users are advised to read the Privacy Policy of official apps and services before entering sensitive information. Downloading unofficial applications or using fake payment methods can compromise personal security and financial data.

📌 4. Accuracy and Updates

The information provided in this article is accurate and up-to-date at the time of publication. However, apptn.in does not guarantee the accuracy, completeness, or reliability of the content as financial scams continuously evolve.

Readers should verify critical information from official sources for the most recent updates and security alerts.

📌 5. Usage and Responsibility

- apptn.in strictly condemns any misuse of the information provided in this article.

- This article is solely intended to raise awareness and educate users about the risks of fake Google Pay scans and online scams.

- apptn.in is not responsible for any losses, damages, or legal actions resulting from the misuse of this information.

📌 6. Legal and Ethical Concerns (Global Scope)

Using, creating, or distributing fake payment apps, QR codes, or any fraudulent financial services is illegal and punishable under the law in most countries, including India, the USA, Europe, and other regions.

Engaging in such activities may result in criminal charges, heavy fines, and imprisonment as per the local laws of each country.

For more information, please refer to:

📌 7. Country-Specific Legal Regulations

- India: Acts of financial fraud and identity theft are punishable under the Information Technology Act, 2000 and the Indian Penal Code (IPC).

- USA: Fraudulent digital transactions violate the Computer Fraud and Abuse Act (CFAA) and Wire Fraud Statutes.

- Europe (EU): Digital fraud and online scams breach the General Data Protection Regulation (GDPR) and EU Cybersecurity Act.

⚠️ Legal Action: Engaging in fraud can result in prosecution, financial penalties, and imprisonment across multiple jurisdictions.

📌 8. Final Note

This article is solely meant for educational purposes to help users recognize and protect themselves against online scams like fake Google Pay scan codes.

To ensure safety and legal compliance, users must rely only on official apps and trusted sources for digital payments.

Thank you for supporting safe and ethical online practices.

More Articles You May Like